|

|

Description

This screen enables you to manage all your tax rates which will you be able to use on the taxation rule creation and edit screen.

Toolbar

- Export : Here, this able to you to get a Csv file from your current displayed tax rates.

- New : Enables you to create a new tax rate.

- Edit : Select a tax rate and then click on this button in order to edit its information.

- Delete : Select one or several tax rates and click on this button in order to completely delete them. When deleting a tax rate be sure that it is not used anymore by any taxation rule. If you delete a tax rate and that there are taxation rules using it, the system will still use those rules and won't apply any tax to the products matching those rules.

- Help : This button enables you to turn ON/OFF the help section, this screen will appear or disappear.

- Dashboard : You can go back to the control panel using this button.

Tax rates filters

- Input filter : Type here, keyword in order to filter your order, like a tax namekey.

- From : Select the start date for filter your orders.

- To : Same idea, than previous but to select the end date.

- Order Status filter : Select here, among all your order statuses to filter your orders.

Note : You don't have to set both of previous filter to get a result to your filter

Note : The 2 last columns can be multiply for each used currency you have configured for your e-shop.

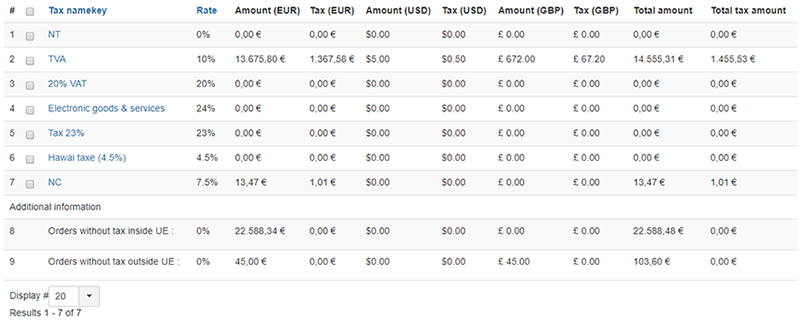

Column Headers

-

# : An indexing number automatically assigned for ease of reference.

- Checkbox : Check this box to select one or more items. To select all items, check the box in the column heading. After one or more boxes are checked, click on the delete button in order to delete the selected tax rates.

- Tax namekey : A namekey, for you to remember the use of the tax rate.

- Rate : The rate of the tax. It is a percentage of the price of the product.

- Amount(currency) : The order total, calculated from the total of order with the tax and in his associated currency.

- Tax(currency) : The Tax total of the order, calculated from the tax total of order in his associated currency.

- Total amount : The total order of the line, calculated from the total of order with the tax and in the main currency of the e-shop.

- Total tax amount : The total tax of the line, calculated from the total of order in the main currency of the e-shop.

Note : The 2 last columns can be multiply for each used currency you have configured for your e-shop.