|

|

Description

This screen enables you to create or edit a taxation rule.

How does tax calculation works in HikaShop ? For example, you might sell food which might be taxed in your country at a low rate and electronics which are taxed at a higher rate in your country. But if you are inside Europe, you will ask the tax to customers only if they aren't a company with a valid VAT number. Then, for customers outside Europe, taxes won't apply. So you have several parts involved in taxation.

First, you can configure several tax categories for your products by going to the Categories HikaShop menu. You might have a category food and a category electronics with the example above. Then, when you add or edit products, you can set a tax category for each.

Then, by clicking on the Manage rates button on the taxations rules screen ( you will see this screen of you click on cancel on the page for which this documentation is for ), you will be able to create tax rates. For example you will create a rate of 5% which will be used for food sales and a 20% rate for electronics.

Also, you might need to create tax zones in the zones management screen, in which you will be able to group states or countries, in order to set a specific rule for all of them in one taxation rule instead of one per state or one per country.

Finally, on this taxation rule edit screen, you will be able to connect all those dots together. You will have to explain to the system which tax rate needs to be used for which tax category in which zone for which type of customer. Thanks to that, the system will then adapt the prices of products on your shop for each customer so that they pay the correct amount. Note that if you set a rule for Texas (a state in the USA) to pay 5% on food and that you have a similar rule for the whole USA to pay 10%. If the customer is in Texas, he will pay only 5%, but if he is in the USA but not in Texas, he will pay 10%.

If no rules match the current situation, no tax will be applied. So, in the example above, you don't need to set any rule for the rest of the world since your customers outside Europe would never pay any tax. Also, please note that as long as the customer didn't enter his address, the main zone and default customer type values will be used to calculate prices on your store.

In order to know what tax rate need to be applied in which circumstance we highly recommend you to seek advice to your local tax office.

Toolbar

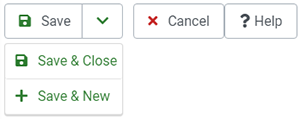

- Save : Save the current taxation rule and return to the taxation rules Management screen.

- Apply : Apply the modifications to the current taxation rule and stay on the same screen.

- Cancel : Return to the previous screen without saving the modifications.

- Help : This button enables you to turn ON/OFF the help section, this screen will appear or disappear.

Information

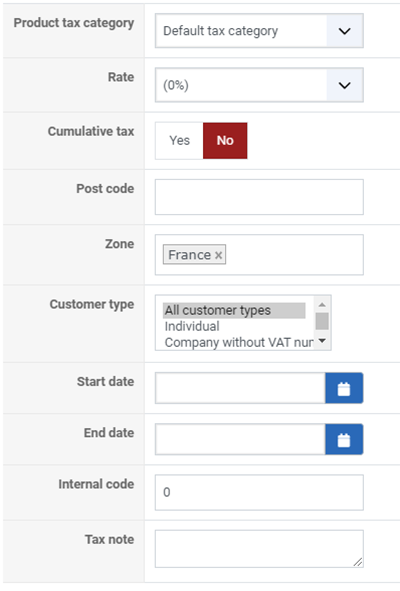

- Product tax category : The rule will only apply to a certain tax category. Each products will be linked to one tax category.

- Rate : If the rule applies to the situation (product in the tax category, customer in the zone and with the correct type), the rate of the rule will be applied to the product price(s).

- Cumulative tax : If you activate that option, it means that the tax can be added up with other taxes.That's mainly useful in Canada where you have both the national and the regional taxes to pay even thought one one needs to be displayed separately on the invoice.

- Post code : You can enter a regular expression matching the post codes you want for the current tax rule.

For example, if you want that the current tax rule apply to all the people with a post code between 12000 and 12999, you would enter such text in the field: 12[0-9]{3}

The brackets indicates the list of potential characters (ie. 0,1,2,3,4,5,6,7,8,9) and the curly brackets indicates the number of characters for the characters in the brackets.

Another example would be all the zip codes from 12546 to 12549 and you would enter: 1254[6789]{1} - Zone : A zone limiting the rule to a certain geographic zone. If you click on the edit icon you can change the zone via a popup. With the delete icon, you can remove the zone limitation.

- Customer type :You can limit the rule to only a certain type of customers.

- Start date : You can set a starting date for your tax rule.

- End date : You can set an ending date for your tax rule.

- Internal code : This value purpose was to associate a code with your tax and won't be display anywereUse it as You can set an ending date for your tax rule.

- Tax note : Use this field as a memo for your tax information.

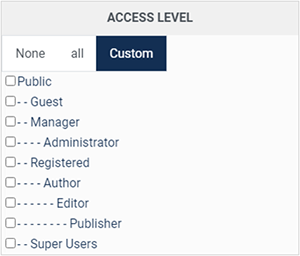

Access level : With the business edition of HikaShop, you will be able to limit a coupon or a discount to specific users.

-

Access level : With the business edition of HikaShop, you will be able to limit a coupon or a discount to joomla groups of users.

- Published : If a taxation rule is published it means that it will be applied on prices based on the product tax category, the customer type and the customer zone. Otherwise, the tax rule will be skipped.

Access level :