Xavier wrote: Hi Cyngen,

In the Shipping method configuration, you can set the option "Override shipping address" to "Your shop address" it will override the address of the customer.

You can too change the tax category of the shipping method.

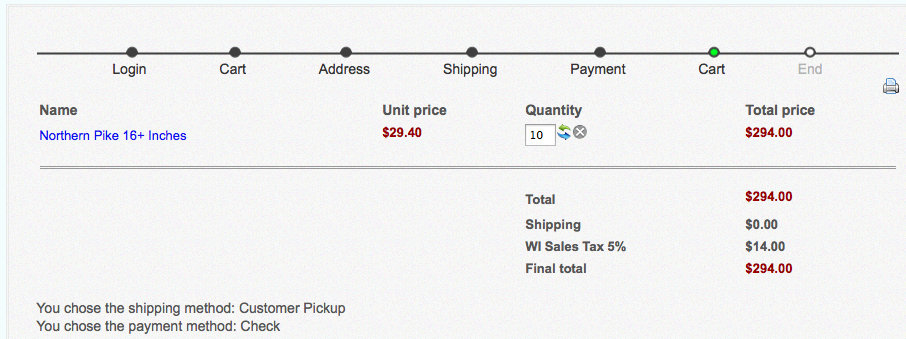

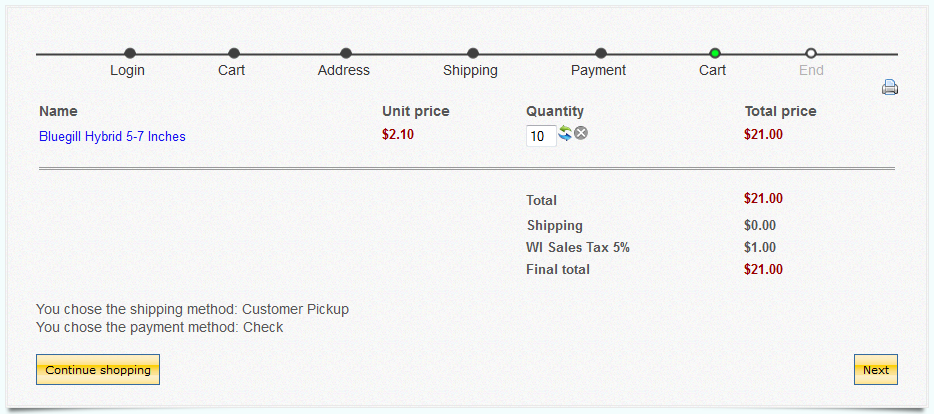

I did all that and I'm not getting sales tax to show up properly. I will include screen shots of what I've configured. The technique should also override all other tax codes including 'out of state' which is zero tax if ordered and shipped there -- except anyone that has a tax exempt number on file.

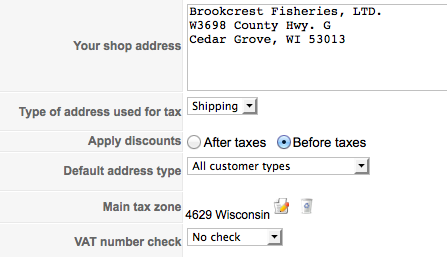

1. Setup of Shop address

2. Setup Tax Zones -- Each County within the State of Wisconsin can have a different sales tax rate. Based upon Nicolas' input, this was setup. There are 73 tax zones setup, one for each County plus 'out of state'.

3. Tax rules have been established and work fine based upon the customers address.

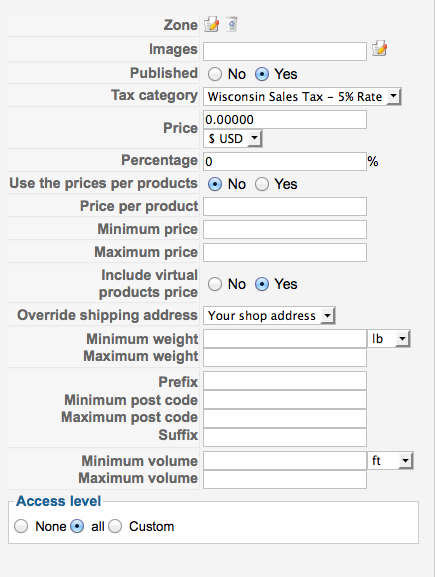

4. Manual Shipping Method - Customer pickup configured.

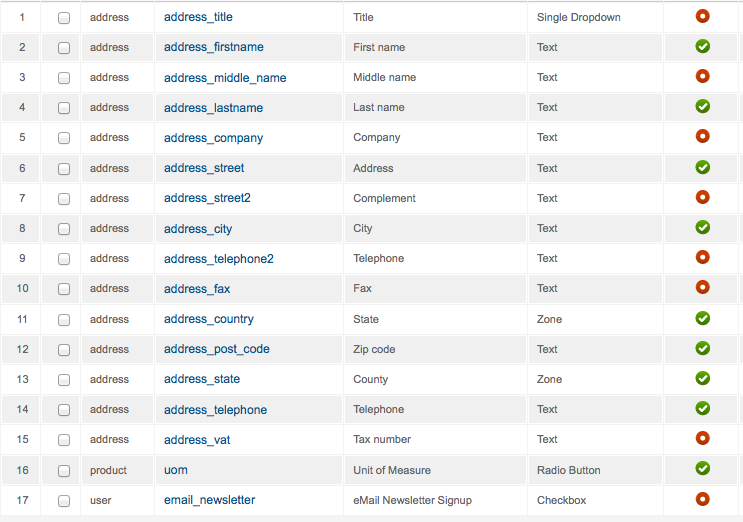

5. Custom fields reconfigured per discussion with Nicolas. The address_country is now 'state' and each state is in the Country zone. The address_state is now 'county'.

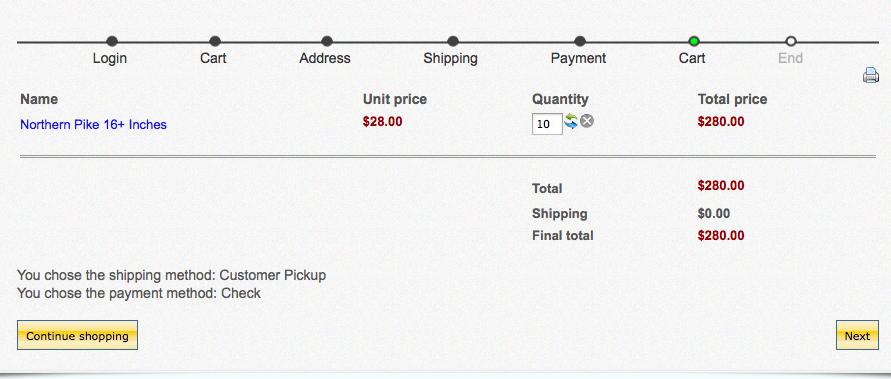

Based upon the customer address for shipping with the county set correctly, the sales tax computes properly. I do not get the tax computed properly from the pickup shipping. Thoughts? Where did I misconfigure?

Thanks,

Kurt

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop