1. You removed the login_address_ part of the checkout workflow. That's what is responsible for handling the user address. If you add it back, the addresses interface will be displayed again.

2. I suppose that it's because you use the SIM API. Here is the explanation from the documentation:

Card validation code : If you have the CCV option activated in your authorize.net account, you will have to activate this option so that the CCV of the credit card is collected and then transmitted to authorize.net. This parameter is only useful for the AIM API.

. You can find more information about the different options of the authorize.net plugin on

www.hikashop.com/support/documentation/6...form.html#additional

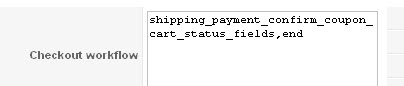

3. You can change your checkout workflow for that. For example, you could have something like that:

login_address_shipping_payment_coupon_cart_status_fields,address_shipping_payment_coupon_cart_status_fields_confirm,end

4. Yes. Yes. Note that you need to set the tax category for your products as well.

5. Yes, for 1. and 3.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop