Hi,

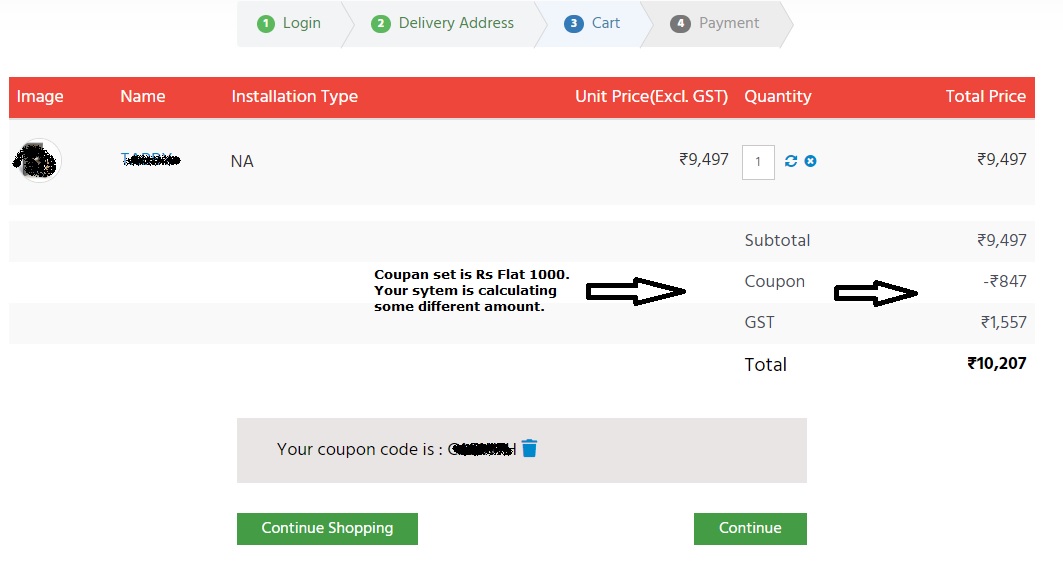

On your screenshot of the checkout, the subtotal is 9,497. That's the sum of the price without taxes of the products in the cart.

Then the coupon is added to it, and then the taxes is taxes for the total amount (subtotal-coupon). and then you have the final total which is: (subtotal - coupon + taxes).

So the coupon value you see there is the coupon value before the taxes are added in.

So 847 is the value removed from the sutotal without taxes so that the value removed from the total with taxes is 1000.

That's why it displays 847 there because otherwise, if the customer sums (subtotal - coupon + taxes) and the coupon value is 1000, the total he would found would be different than what is displayed.

The alternative would be to move the taxes row before the coupon row there and display the taxes without taking into account the coupon so that we could display the total coupon value and the sum of the different elements would still match.

Basically, what I'm saying is that the calculations and the display are correct there.

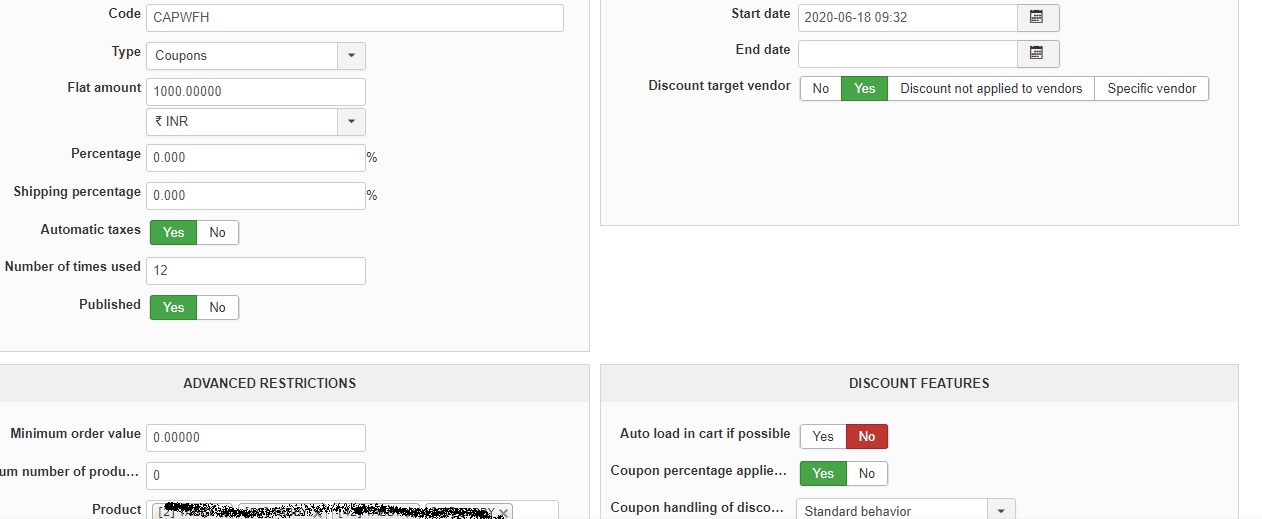

You can of course change the value displayed for the coupon with a bit of code modification in the view displaying that area. To do that, edit the file show_block_cart.php and change the line:

echo $this->currencyClass->format(@$cart->coupon->discount_value_without_tax * -1, @$cart->coupon->discount_currency_id);

to:

echo $this->currencyClass->format(@$cart->coupon->discount_value * -1, @$cart->coupon->discount_currency_id);

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop