I have just spent 2 hours reading this forum and trying it out. Here is the step-by-step guide on HOW TO SET UP TAXES FOR CANADIAN PROVINCES (as of 2015)

1. System>Configuration>Taxes> Main tax zone – set to Canada

2. System>Taxes>Manage tax categories – leave Default tax category

3. System>Taxes>Manage Rates>NEW – this is where you set up tax rates for each province.

Tax namekey should be e.g. ON (GST), QC (GST), NB (HST) because that’s how it will show up on the checkout. Then add Rate – 13, 5, …

Now you have the rates prepared and you have to connect them with the proper Zones. Go to:

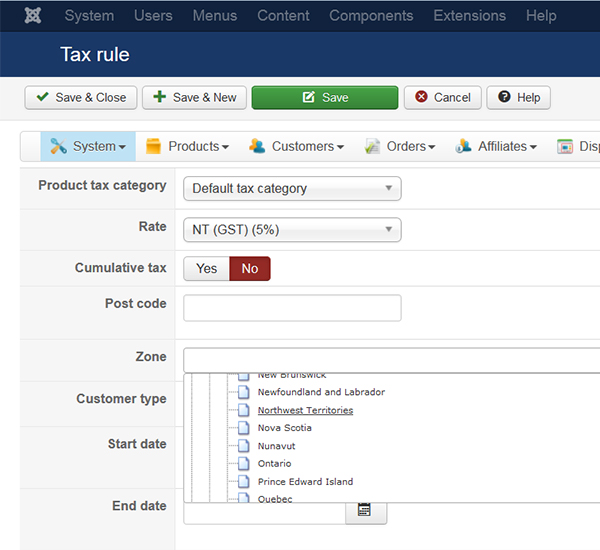

4. System>Taxes> make sure you see Tax rules title on the top, and +New

Product tax category – Default tax category

Rate – choose a province with the rate

Cumulative tax – No This would be used before when we had two types of taxes in one province

Zone – choose the appropriate province from the dropdown. Make sure it matches the Rate!!!

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop