-- HikaShop version -- : 3.5.1

-- Joomla version -- : 3.8

-- PHP version -- : 5.6

-- Browser(s) name and version -- : firefox

I am creating an e-Commerce site for a business located in Quebec selling to customers in different parts of Canada and I am trying to set up the taxes component.

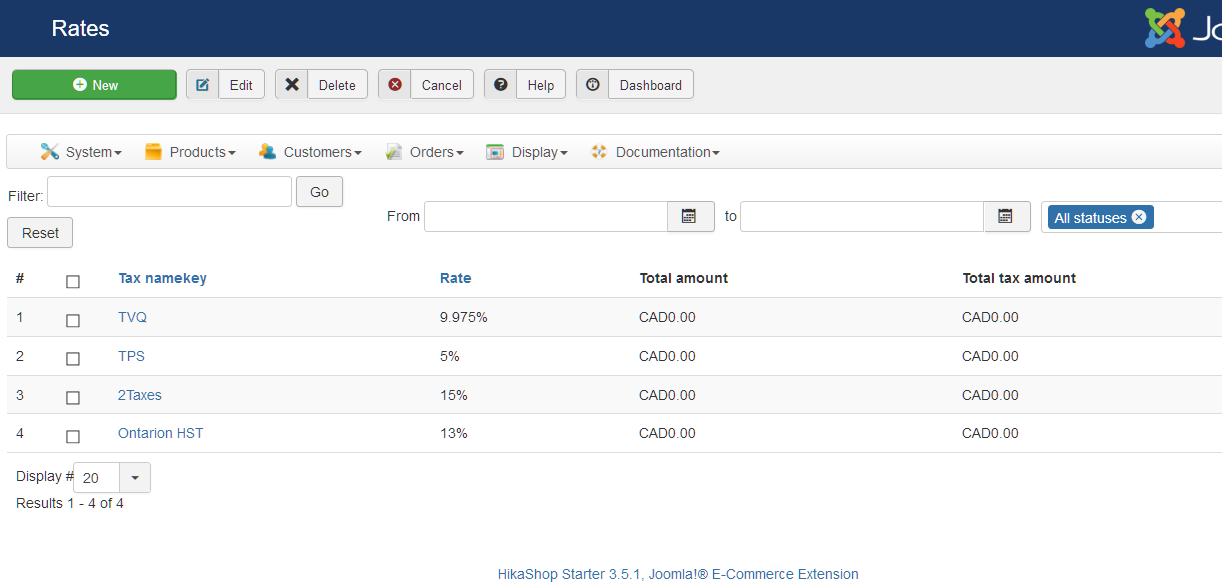

In some provinces like Quebec there are 2 taxes PST and GST which are cumulative ( GST = 5% x Price + PST = 9.975% x Price to give a total of 15%). In other provinces like Ontario the is one harmonized tax ( HST 13%).

Attached are screen shots of my setup. I tried a lot of permutation without success.

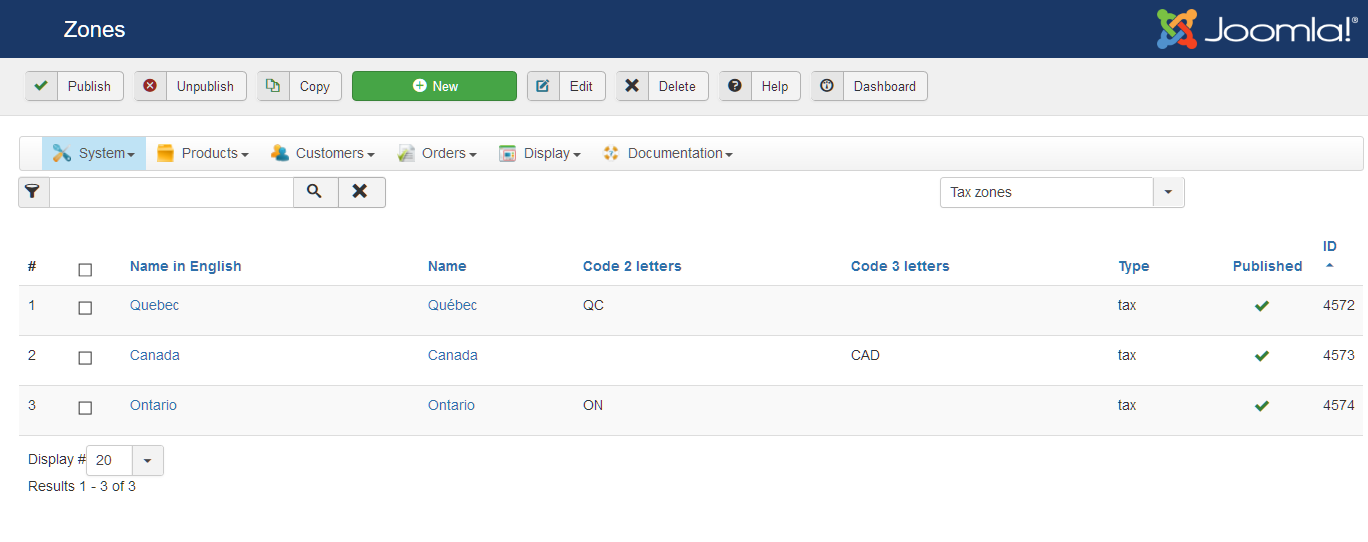

Zones

Rates

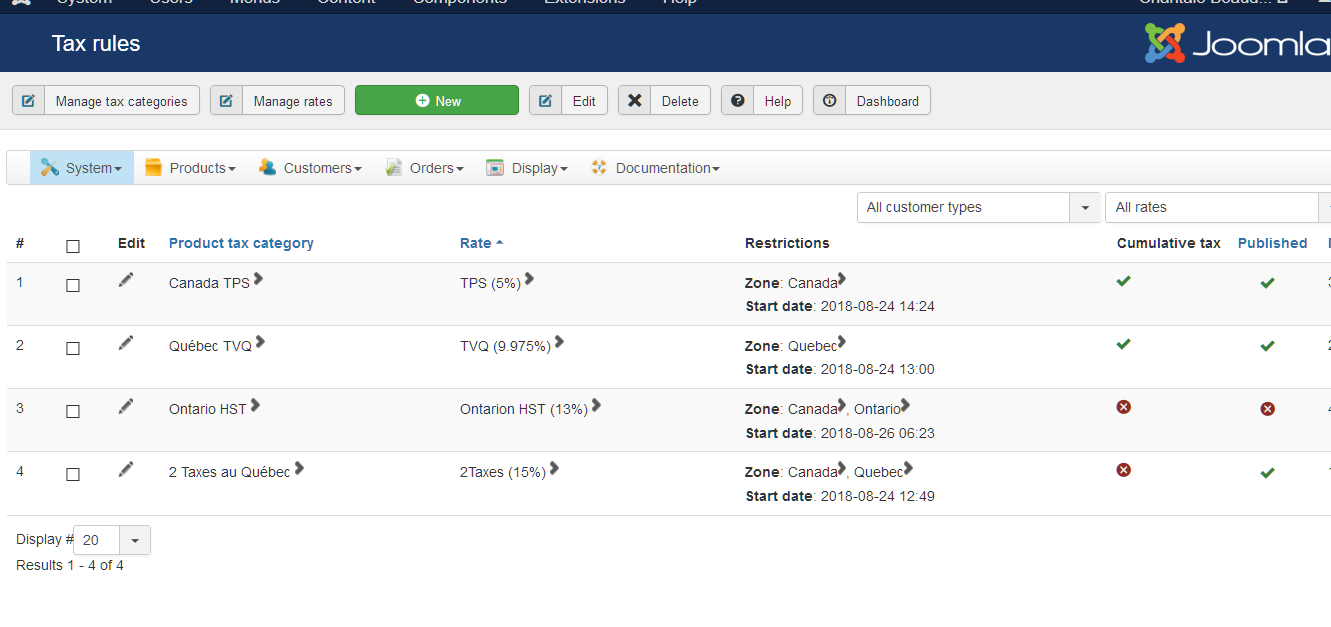

Tax rules

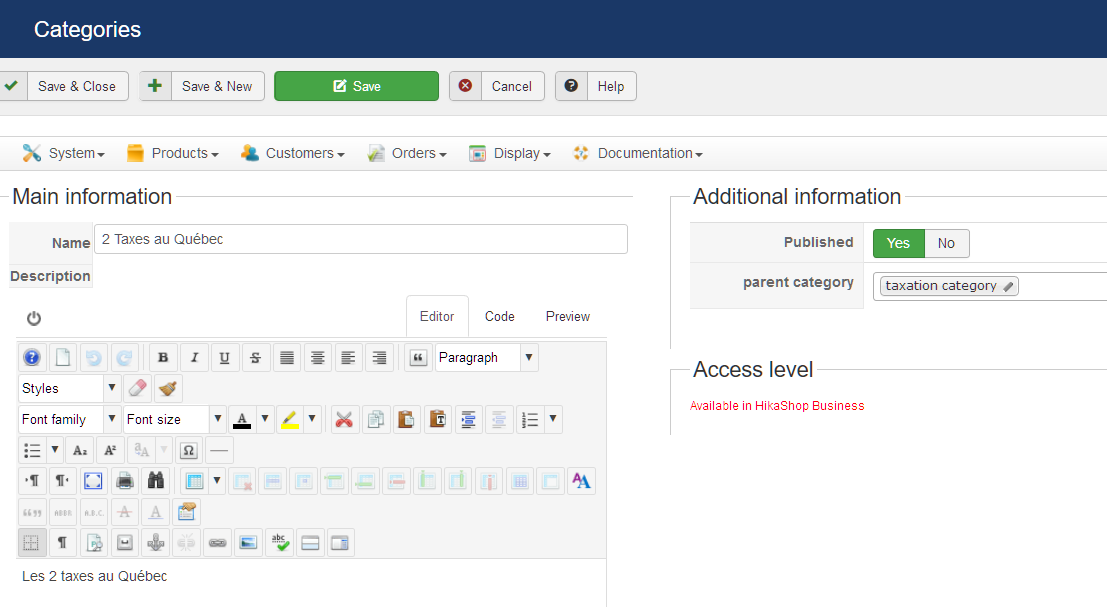

Tax categories

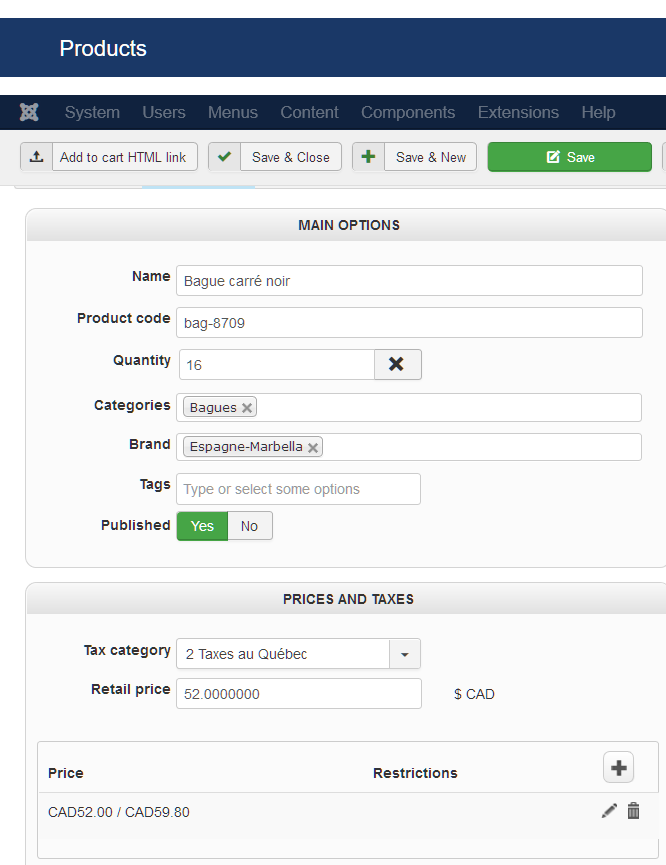

Product with 2 taxes

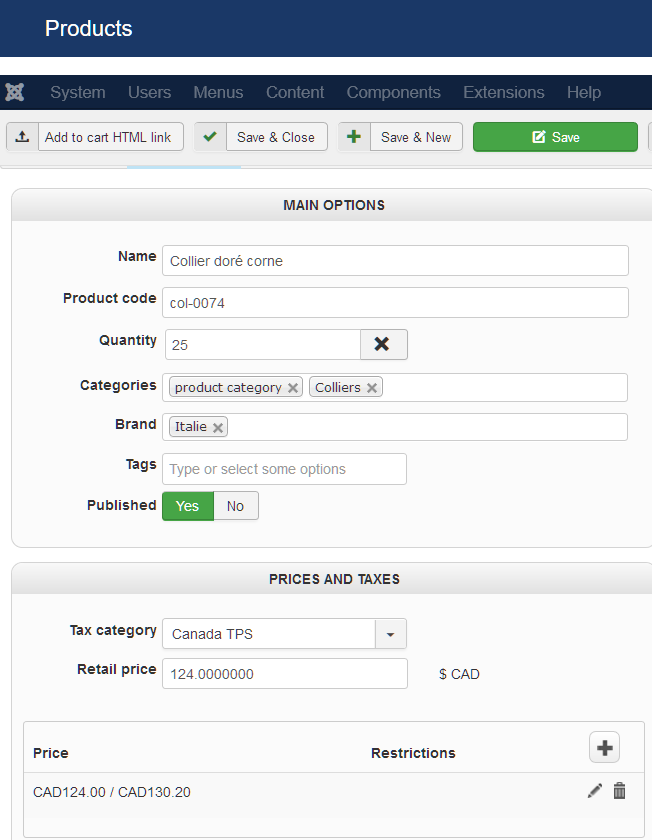

Product with PST (TPS in French)

I do not quite understand how the cumulative works.

I am not sure I set up the Zones Correctly. I have set up a Zone for Canada with 2 zub-zones one for Quebec and one for Ontario, but I see there are State zones and Tax Zones, I do not understand the difference and when either should be used.

I thought the taxes rate would be applied according to the address of the customer. But if, in the product, I have the 2 Quebec taxes, and the customer is from Ontario, the Quebec taxes are applied. Vice versa, if I have the Ontario tax in the product and the customer is from Quebec, the Ontario tax is applied.

I read the document «Taxation rules listing» where you state that in taxation rules screen «You will have to explain to the system which tax rate needs to be used in which zone for which type of customer» My question is HOW DO I DO THAT?

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop