Hi,

You need first to go in the menu System>Taxes and click on the "manage tax rates" button. There, you'll be able to create all the tax rates via the "new" button. I would recommend using names like "Alabama Sales Tax".

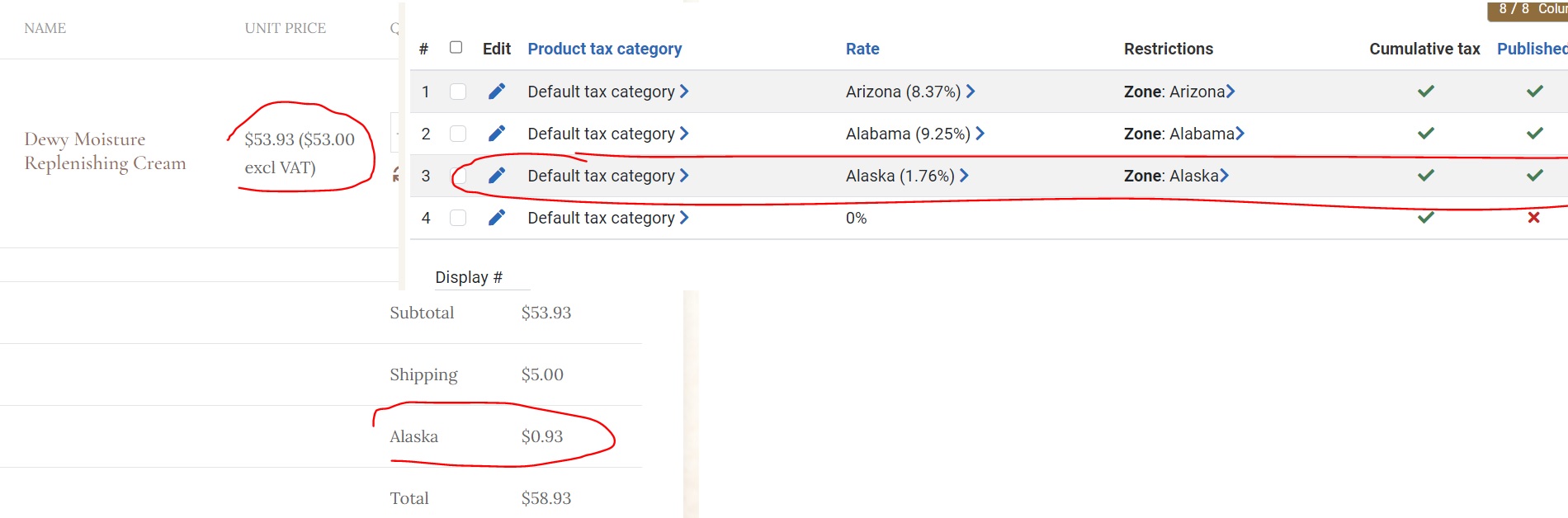

Then, go back to the System>Taxes and click on the "new" button to create new tax rules.

You'll need one tax rule per state.

In each tax rule, select the tax rate (for example "Alabama Sales Tax") in the "tax rate" setting, the corresponding state zone in the "zone" setting, the "default tax category" in the "tax category" setting and publish the tax rule.

In each product, make sure you select the "default tax category" in the "product tax category" setting.

Then, on the checkout, the tax should be automatically calculated based on the address entered by the user once he enters it.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop