Hello,

Here, there are no "stupid question" only things to explain in order to make everybody progress in HikaShop management!

For your first point :

"...The Total amount is not exactly corresponding with the Tax amount. I.e. it looks like the "Total amount" is the total amount of the invoices and seems to contain transport cost which is free of VAT. Could this be the case?"

This will depend from your different settings around taxes but one important things if all your shipping method are free (and not free of VAT) then there are no impact on your VAT calculation.

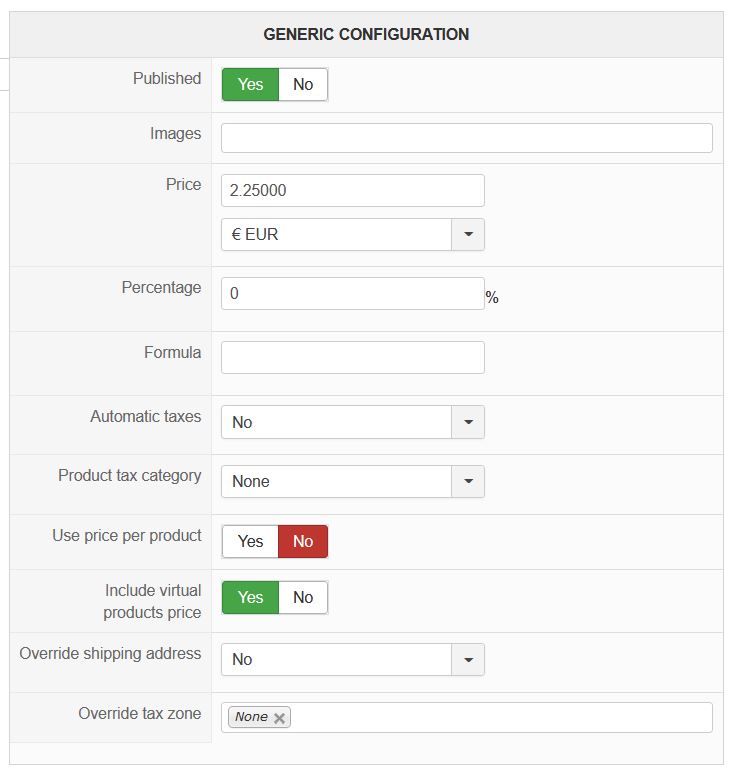

Now, if your shipping method aren't free AND all your Shipping method is set like on my screenshot :

In your shipping method form => GENERIC CONFIGURATION part

=> There are no reason that it impact the VAT total.

Can you investigate more in order to maybe find a good reason for your results, settings & re-check your VAT calculation.

Awaiting your results.

Regards

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop