Hi,

On your screenshot

www.hikashop.com/media/kunena/attachments/61700/product_2.JPG

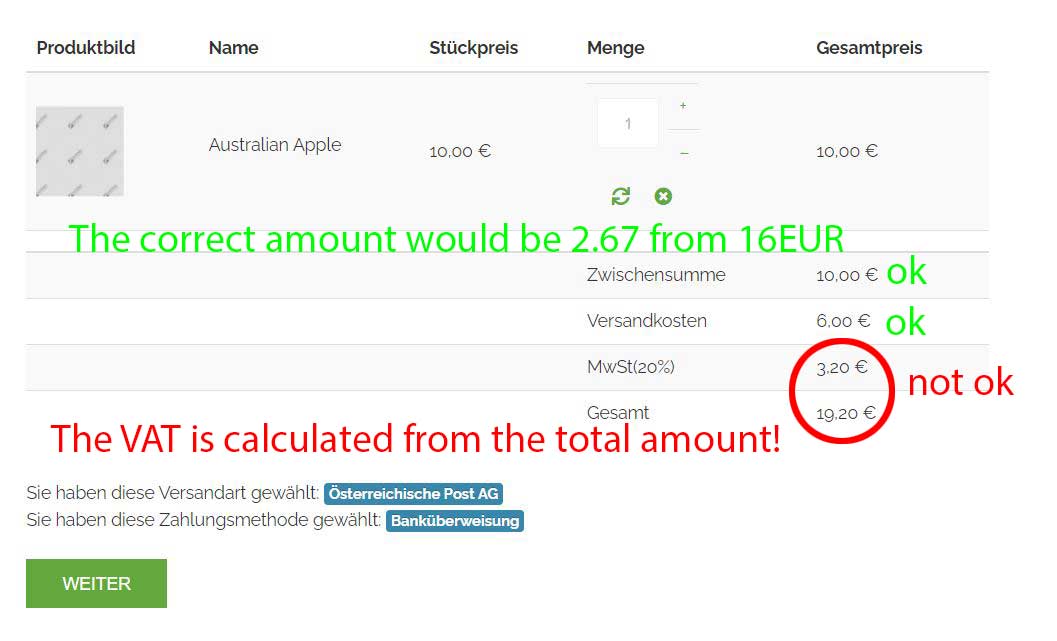

I can see that you entered a price without taxes of 10 and a price with taxes of 12.

Now, you're telling me that you want the price with taxes to be 10. So you need to change that in the settings of your product.

Then, in the HikaShop configuration, you want to change the "show taxed prices" to yes so that you display the prices of the products with the taxes on your shop and not the prices without taxes.

Now, if you want the price with taxes displayed to the customer to be always 10, regardless of where they are based, and then that the tax is calculated dynamically off of it, then you want to activate the "floating tax prices" setting in the HikaShop configuration. And in that case, when you edit the price of a product, you'll see that instead of having both a "price with tax" and a "price without taxes" input there, you'll have only the "price with taxes" input where you'll be able to enter 10.

Also, I can see that you selected the tax category MWst 20% in your product. That means that only the tax rules with that tax category selected will be taken into account on the frontend. However, one of your tax rule, you've selected another tax category. This means that this tax rule will never be used for that product.

In your case, you want only one tax category, assign all your products to that tax category, and all your tax rules to that tax category.

Tax categories are useful when you sell things that needs to be taxed differently in the same area. For example, if you sell alcohol taxed at 30% and books taxed at 5% in the same shop in the same country, you want two different tax category for the different products.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop